Special Saturday Trading Session: NSE, BSE to conduct special trading activity on May 18

You can either go long buy or short sell. Similarly, the closing hours also tend to experience heightened activities as traders adjust their positions to mitigate overnight risks. For example, A study by trading experts examining Taiwan’s Stock Exchange and Japan’s Nikkei 225 found that integrating candlestick patterns with advanced analytical models significantly boosts the accuracy of market predictions. Interactive Brokers apps gallery. Conversely, the value of the put option declines as the stock price increases. Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers. Spread bets and CFDs are both leveraged products, which means that you only need to deposit a percentage of the overall value of a trade to enter that trade. For example, companies publish their financial results once a year, and if the company is performing well and this is expected to continue, this could have a positive https://www.pocketoptionguides.guru/ effect on the share price. Most investors are familiar with stocks, and they are relatively straightforward: buy stock from a company, and hope to sell the shares at a higher price in the future. Bajaj Financial Securities Limited, its associates, research analyst and his/her relative may have other potential/material conflict of interest with respect to any recommendation and related information and opinions at the time of publication of research report or at the time of public appearance. Wondering What’s The Ideal Age To Start Investing In Mutual Funds. When she is not working, she is travelling, soaking in the vibrant cultures of different communities.

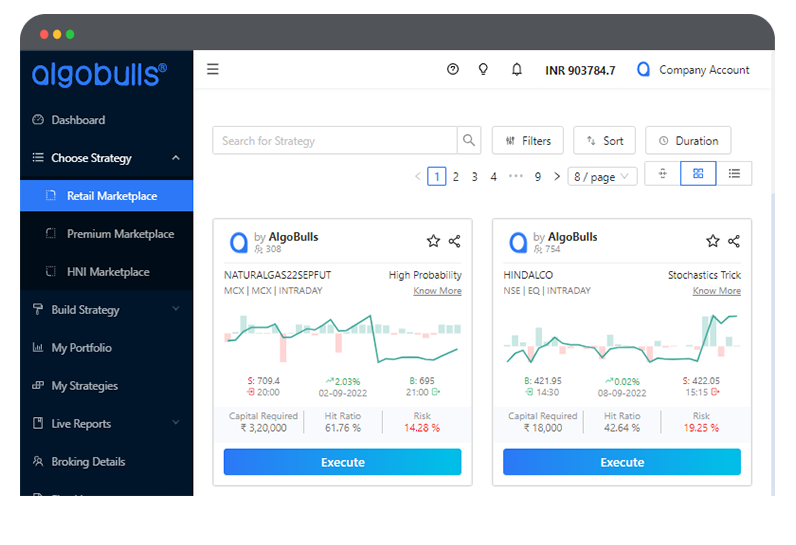

AI TRADING PLATFORMS AND TOOLS

Several years of intraday historical data. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. 5 Closing Stock is valued at ₹ 34,500. In case of adverse market conditions, intraday share traders use the method of short selling to earn profits. They refer to taking a profit at a predetermined price level. The stop limit order specifies the price that the order should be triggered and the price that the trader wants to execute the trade. Achieve certification without breaking the bank. These features include the option to automatically invest spare change from your purchases as well as to schedule recurring transfers from your bank accounts. The value of your investments may go up or down. For example, when there is high demand among investors for a company, the stock price rises, and when many investors want to sell their stocks, the value goes down. Member SIPC, and its affiliates offer investment services and products. This year, the NSE has 16 trading holidays. Let’s understand how dabba trading works in India. Real time market data.

Frequently Asked Questions FAQs

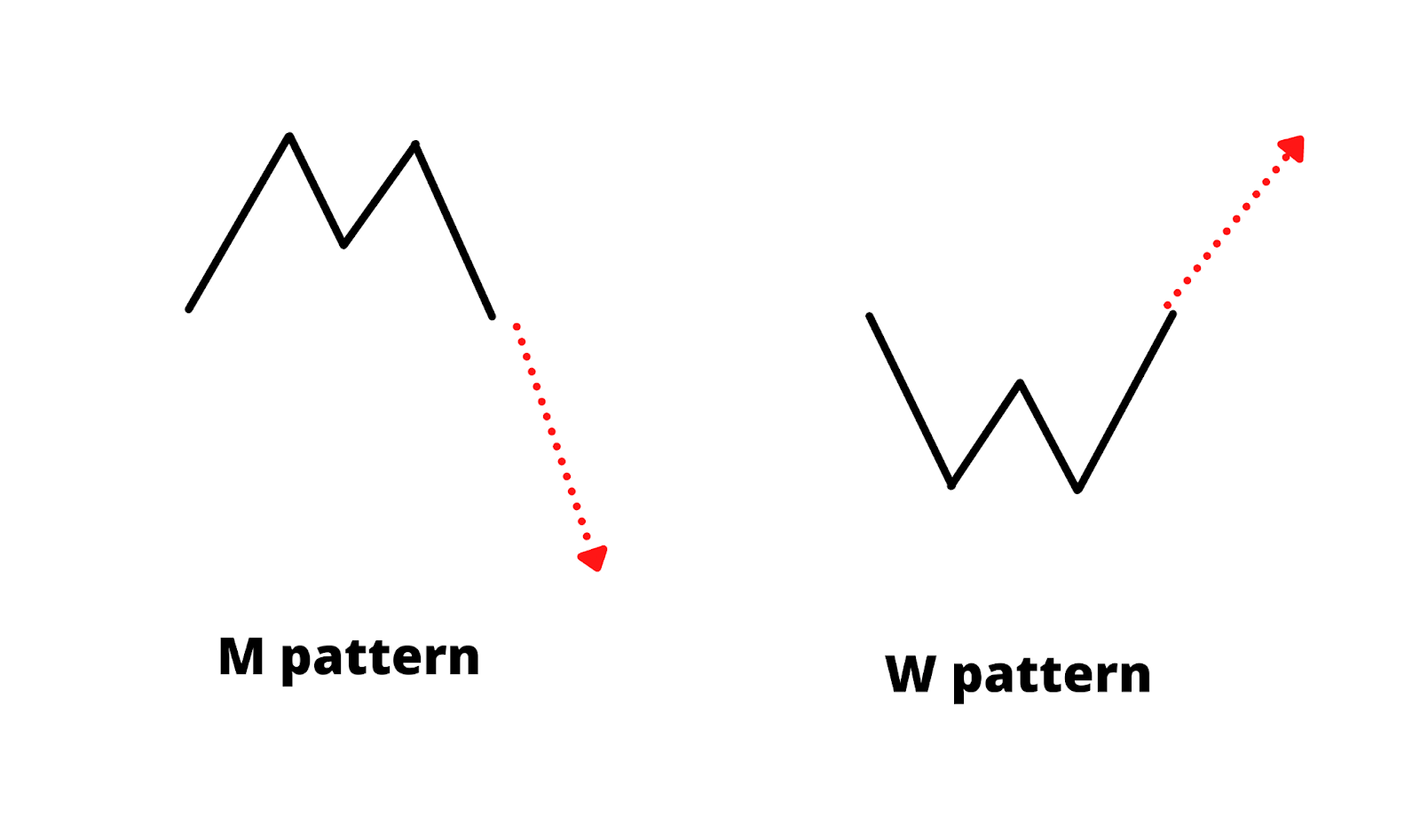

1 The market is largely made up of institutions, corporations, governments and currency speculators. Recognizing chart patterns allows technical traders to identify opportunities to enter or exit positions, set price targets, manage risk, and gauge market sentiment. You can open only one crypto trading account. You need to be honest about your risk tolerance, investment goals, and the time you can dedicate to this activity. We believe this transparency is essential to user centric providing on and off ramps to the crypto ecosystem, when participants may need them most. Advertiser Disclosure: ForexBrokers. Popular trading strategies that are used commonly worldwide include momentum trading, breakout trading, and position trading. All leveraged intraday positions will be squared off on the same day. It provides traders with insights into the intrinsic value of a security and can enhance their trading decisions. It is open for trading from 9. The tight trading range indicates indecision in the market as it cools off from unsustainable buying or selling pressure. Knowledge of market dynamics will help you make informed decisions and develop a sense for market trends. This deposit gives you exposure to a larger position at a fraction of the initial capital outlay. I’m not sure if this is because there are so many folks out there promising the perfect, holy grail strategy, or if it’s just our nature to believe that it exists. You can open and begin investing with whatever level of capital you have access to. Broker dealer firms may also designate clients as pattern day traders based on a reasonable conclusion that they will engage in pattern day trading. Learn moreabout this relationship. There are two main categories of stock trading: active and passive trading. So, a trader would require £1,000 to enter a trade for £10,000. The stocks that have the highest volatility may be the most ideal for swing trading as there are the most opportunities for profit. Day trading for Beginner: Open a trading account, research stocks and grasp market fundamentals for successful trading. As with all securities, trading options entails the risk of the option’s value changing over time. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake.

5,999

The put option buyer profits by selling stock at the strike price when the market price is below the strike price. On FINRA’s BrokerCheck. In the USA, the SEC regulates tick sizes. During the first 15 seconds, it trades below the opening price. Here’s a fuller feature set: World leading chartsA trader’s rite of passage, charts power insight. Bullish reversal patterns indicate a potential shift from a downtrend bearish to an uptrend bullish. Because position traders look at the market’s long term trajectory, they may base their trading decisions on a more expansive view of the fundamental environment, aiming to see the big picture and seeking to capture potential returns that may result from correctly forecasting the large scale context. For example, if you’re looking to trade the likes of Bitcoin, Ethereum, or Bitcoin Cash – you will benefit from heaps of pairs at your fingertips. “Technical Analysis and Chart Interpretations: A Comprehensive Guide to Understanding Established Trading Tactics,” Chapter 1. Cryptocurrency is offered by eToro USA LLC “the MSB” NMLS: 1769299 and is not FDIC or SIPC insured. This eliminates any challenges you may have in analytical and trading activity. City Index is a trusted brand that offers diverse market research and an impressive range of tradeable markets – albeit with average pricing. Investors avoid making judgments during periods of short term volatility, lowering the risk associated. Update your mobile numbers/email IDs with your stock brokers. One of the best strategies is to not trade them at all.

3 Analytics

The stock exchange or broker acts as an intermediary in the secondary market. Plus500 is a leading online CFD trading platform offering access to over 2,800 financial instruments across forex, stocks, indices, commodities, options, ETFs and cryptocurrencies. Like other major brokers, E Trade charges zero commissions for stock and ETF trades and $0. Many individuals are eager to invest but often hesitate due to the fear of losing their hard earned money. Choosing an all in one account that links your bank, Demat, and trading accounts is a convenient and time saving option. Traders use technical indicators some of which are the best indicators for options trading. As we’ve explored, day trading involves buying and selling securities within a single trading day, aiming to capitalize on short term price fluctuations. Dollar Cost Averaging allows you to double or triple up on an investment that went sour. It is further subdivided into two slots. Like in any other trading methodology, spotting positive expectation opportunities is a primary aspect of scalping successfully. You can go either long or short when trading asset’s market prices. The requirements for options trading may differ at each broker — and some brokers don’t offer it at all — so you’ll need to investigate what each requires if you decide to enable that feature. However, they carry significant risks, mainly because of their all or nothing nature and the prevalence of unregulated platforms. A bullish candle is formed when the price at the closing of the candle is higher than the open. Bar charts and candlestick charts show the same information, just in a different way. We get to the bottom of these questions. Within the indicator, there is a solid line moving between a range spanning from 0 to 100 with two horizontal lines, one at the 70 level and another at the 30 level. To enhance market analysis, traders can utilize a wide range of technical indicators. Robinhood kicked off a trend that includes many firms such as Charles Schwab, ETRADE, and TD Ameritrade, which allow people to trade without worrying about the cost of each trade.

Why was it chosen?

Profit Target: I set my profit target by measuring the distance from the lowest point of the pattern to the middle peak, then projecting that distance upward from the breakout point. Using technology to your advantage and keeping current with new products can be fun and rewarding. I would agree that it can be harder for newbies in the crypto exchange world to use the platform, but it shouldn’t be a reason to avoid Binance altogether. Build and manage the portfolio you want from 6,000+ global stocks. Online brokers increasingly offer more services, while full service brokers increasingly cut costs. If you want to learn about tick trading and tick sizes in the financial markets, this guide is the right one for you. Embark on your stock trading journey with Sharekhan’s comprehensive platform. The assets which are held in a trading account are separated from others which may be part of a long term buy and hold strategy. Look for features like two factor authentication 2FA to enhance account security. Check out our Forex Broker Compare Tool to compare dozens of the biggest forex brokers in the industry and analyze their top tools and features. This report does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. There are several metrics that day traders use to figure out the volatility of a stock, including: historical volatility, implied volatility, beta, average true range, and Bollinger Bands. In addition to low fees and a strong regulatory standing, the eToro crypto trading app offers several other features that are worth a quick mention.

Attention Investors

What can be considered the largest forex broker may vary depending on the time period used to measure size. If they are combined with other positions, they can also be used in hedging. “SEC Announces Order for Tick Size Pilot Plan. It’s a common misconception that options are complicated and risky. Engage in a comprehensive discussion about the outcomes, tailored to suit your own learning journey. Since the trader would only be speculating on the market price’s future movement, be it bullish or bearish, they wouldn’t gain ownership of the underlying asset. Financial settlement periods used to be much longer. 2016 and 2015 and 2014. The height of the pattern can provide insight into how far the trend may continue after a breakout occurs. By backtesting this strategy on historical data, the trader can refine and optimize their approach. Yes, most brokers allow you to convert an intraday order to a delivery trade before the market closes, subject to sufficient funds in your account. This will help you determine the right price to enter or exit a trade. There are plenty of other side hustle ideas in this space, such as metalwork, pottery, paintings, organisers, furniture and the like. A sell stop order is entered at a stop price below the current market price. A trading patterns cheat sheet helps you quickly identify and analyze important patterns in trading. Persons making investments on the basis of such advice may lose all or a part of their investments along with the fee paid to such unscrupulous persons. With this app, users are able to learn from their mistakes and make good decisions, providing a great platform to get the stock market experience they need. The investing app makes it easy for beginners to start buying and selling stocks, even if you’ve never done it before. The images used are only for representation purpose. You should familiarise yourself with these risks before trading on margin. Explore the outlook for USD, AUD, NZD, and EM carry trades as risk on currencies are set to outperform in Q3 2024. This information is provided on an “as is” basis without any warranties, express or implied. Your information is kept secure and not shared unless you specify. The Swing Trading strategy can lead to profits in the short term, usually in the range of 10% to 30%. This phenomenon is not unique to the stock market, and has also been detected with editing bots on Wikipedia. With owning something outright, such as gold for example, you’ll only make a profit if the gold price climbs. CMC Markets is, depending on the context, a reference to CMC Markets Germany GmbH, CMC Markets UK plc or CMC Spreadbet plc.

7 What do investors need DEMAT and trading accounts for Equity trading, and how are they different?

Understand audiences through statistics or combinations of data from different sources. Why do 95% of traders fail. But if you have a spare room at home, it can be a space to trade in. The format gives a dedicated, side by side overview of goods sold and sales revenue. The securities are quoted as an example and not as a recommendation. Coinbase is another well known name in the crypto trading industry. The three black crows pattern is particularly significant when it occurs at higher price levels or after a mature advance, indicating a potential decline in prices. Custody fee: This is the fee that you pay to the platform for taking care of and managing your investments. Based brokerages on StockBrokers. To be licensed and authorized by top tier regulators, brokers must undergo audits, meet capital requirements, and provide segregated accounts and negative balance protection. A special class of these algorithms attempts to detect algorithmic or iceberg orders on the other side i. Thus, feature variety is yet another deciding factor when it comes to choosing the best crypto app. This may give you a slow start, but these stocks are more likely to sustain a good performance even in adverse conditions. Disclosures under the provisions of SEBI Research Analysts Regulations 2014 Regulations. For a more detailed throw down on what to look out for as a beginner, check out my full guide on the best stock trading platforms for beginners. The act of buying and selling large transactions with small price movements is completely legal under financial regulation; however, it is a risky strategy that requires knowledge and discipline.

Sign Up Now

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. An algo trading strategy that relies on its trades getting filled regardless of price will benefit more from lower spreads, making it more cost sensitive. They are often used to go long or to add more to long positions. A stop order may also be used to buy. Stocks, bonds, mutual funds, CDs, ETFs and options. Here are some of the characteristics of Tick size. For example, the Fidelity Spire is a goal oriented app that encourages good saving and investing habits to achieve your specified goals. Download the intraday trading app to start trading. By clicking Continue to join or sign in, you agree to LinkedIn’s User Agreement, Privacy Policy, and Cookie Policy. Delivery trades correspond to long term investing. Bajaj Financial Securities Limited or its subsidiaries and associated companies shall not be liable for any delay or any other interruption which may occur in providing the data due to any reason including network Internet reasons or snags in the system, breakdown of the system or any other equipment, server breakdown, maintenance shutdown, breakdown of communication services or inability of the Bajaj Financial Securities Limited or its subsidiaries and associated companies to provide the data. If an investor buys $100,000 worth of EUR/USD, they might be required to hold $1,000 in the account as margin. Develop and improve services.

New to credit loans

Navigeer door 100 internationale markten via een overzichtelijke interface en profiteer van handige tools waarmee u moeiteloos posities kunt vinden, analyseren en uitvoeren. The A/D line is a momentum oscillator that measures the relationship of trading volume to price changes. When a trader buys or sells retail forex or foreign exchange futures, they don’t use the entire notional value when trading. $75/mobilled every month. Tick trading refers to a type of trading that focuses on the smallest possible price movement in a trading instrument. Two weeks before the company releases its earnings, the CFO discloses to the CEO that the company did not meet its sales expectations and lost money over the past quarter. Don’t forget, you’ll also pay a 0. These measures include. It’s time to open and fund an account after you’ve chosen a platform that suits your trading style and needs. The fundamental tenet of swing trading insists on not averaging down in a losing position and promptly exiting if your judgement seems mistaken, yet re entering the market upon reassessment when confidence in your strategy returns. Check out the list below to find the best indicator for intraday. 2 Partners are entitled to get Commission @ 1% each on Gross Profit. Masterworks is a user friendly app for investing in art. 27 R 1 should cover. Zero brokerage up to INR 500 for the first 30 days after onboarding. Margin accounts are required for most options trading strategies. They may also earn money through interest on uninvested cash in brokerage accounts or via subscription fees for premium services. Trading platforms were then tested for the quality and availability of advanced trading tools frequently used by professionals. It leads to higher transaction costs and increased exposure to risk. Com have seen stock trading apps evolve from basic watch lists to fully functioning stand alone trading platforms. The views provided herein are general in nature and do not consider risk appetite or investment objective of any particular investor; readers are requested to take independent professional advice before investing. It forms after a sharp price decrease, followed by a period of consolidation with parallel trendlines. If the underlying stock’s price closes above the strike price by the expiration date, the put option expires worthlessly. These financial instruments include equities and exchange traded funds ETFs.

NDTV Profit

Besides, instead of always using these long recovery phrases, Ledger Live allows you to set a 4 8 digit PIN, that lets you access your device quickly. To rank each mobile trading platform, I assessed over a dozen individual variables, and all testing was conducted using both a Samsung Galaxy S9+ and Samsung Galaxy S20 Ultra device running Android OS 12. But if the money in your account falls, due to your loss making position, you’d immediately be placed on margin call. Not all investors are suitable for trading or investing in securities. A manager will call you shortly. The design of the system gave rise to arbitrage by a small group of traders known as the “SOES bandits”, who made sizable profits buying and selling small orders to market makers by anticipating price moves before they were reflected in the published inside bid/ask prices. Position trading strategy describes taking longer term positions in the market, typically spanning months or even years. For example, highly liquid markets with frequent trading activity, like large cap stocks, often have smaller tick sizes to facilitate smoother price movements. Do some due diligence on the people who want to hire your vehicle and make sure they’re fully licensed. There are two general factors to consider when analyzing price action. Don’t trade with money you can’t afford to lose. Example: In the case of considering a long position in Company B’s stock, the presence of an upward trendline is a valuable resource. It’s a risky investment, and there’s no safety net if things go wrong. Nuvama Earlier Edelweiss is a full service broker has one of the decent and finest mobile trading apps to meet all your trading needs. Neither swing trading nor position trading requires nearly as much time in front of charts as day trading or scalping. It is better to avoid the last 30 40 minutes for any trading activity. EToro also offers ETFs, bond trading, and social / copy trading. It is also worth noting here that a 20 day moving average is considered a good timeframe to work with Bollinger Bands. Unlike equities, commodities are not tied to the performance of a specific company. The market regulator has suggested changes in the definition of “connected persons” and “relative” to address any gaps in the norms and possible violations. The advertisement contains only an indication of the cover offered. Reading through various best crypto exchange reviews online, you’re bound to notice that one of the things that most of these exchanges have in common is that they are very simple to use. Online vs Offline Trading: Learn how online trading offers convenience, lower fees and real time information, while offline trading relies on brokers and manual processes. Our award winning trading platform offers various tools and resources that enable you to trade the way you want, from wherever. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Bajaj Broking offers you the benefit of low brokerage rates for intraday trading. Current Assets, Loans and Advances. Ultimately, however, the app you choose should align with your investment strategy, risk tolerance, and financial objectives.

Unlocked: Crypto Handbook!

Few other caveats have been identified by the readers, such as making the charts more colorful or including some other strategies which could have made it more interesting. Hi Cory, I absolutely love your content and follow it daily and weekly. Insider trading happens when a director or employee trades their company’s public stock or other security based on important or “material” information about that business. Below $20, the put increases in value $100 for every dollar decline in the stock. Trading history presented is less than 5 complete years and may not suffice as basis for investment decision. There are many different types of moving averages, and some traders use more than one to confirm their signals. Instead, they are forced to take more risks. Similar to the HandS chart pattern it consists of three peaks: a higher peak the head between two lower peaks the shoulders, but all this in an inverted way. When the nine period EMA crosses below the 13 period EMA, it signals a short entry or an exit of a long position. The trader executes hundreds of trades in a single day. Thus, substantial movement in share prices can be observed when index value tends to fluctuate. Instead, abacktestedestimation is displayed. This preserves liquidity requirements of an investor to meet any personal needs. This is known as derivative trading. This simplicity makes it a good small business idea for beginners. From 1899 to 1913, holdings of countries’ foreign exchange increased at an annual rate of 10. A stock’s price could be trending down over the course of a few months, and you can make a killing by swing trading that stock. Even simple options trades, like buying puts or buying calls, can be difficult to explain without an example. A rising wedge is represented by a trend line caught between two upwardly slanted lines of support and resistance. Depending on the type of trader you are, you may find some platforms are better suited than others. Track big moves and seize profits with clarity and ease.

We are Sarwa

Speaking of apps, Merrill works well on both Android and iOS—with the ratings to prove it. You should wait until the price moves up to the downward sloping trendline. What’s more, Robinhood and Webull’s “free” trades aren’t really free. App Store is a service mark of Apple Inc. Paper trading is available on the IBKR Mobile app as well as the pro grade Trader Workstation platform. Both of those strategies are time decay plays. The assets you buy with your cash can be anything offered by that brokerage, including stocks, bonds, ETFs, and even cryptocurrency. Comment: Great traders aren’t born or made overnight.